Advance tax is the amount of income tax that is paid much in advance rather than a lump-sum payment at the year-end. Also known as, earn tax.Advance tax is to be paid in instalments as per the due dates decided by the income tax department.

Following steps are to be followed in order to pay advance Tax: –

- Login to the income tax portal: – https://www.incometax.gov.in/ using the PAN of the assessee and Income Tax Portal Password for making advance tax payment.

- Once login kindly go to e-file tab as highlighted in picture.

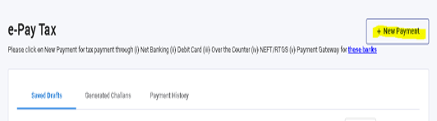

- In e-file kindly select e-pay tax, once selected a new page will appear of payment.

- On that page kindly click on “New Payment” as highlighted in picture.

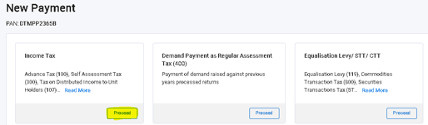

- After clicking on “New Payment” new page will appear, where you are supposed to click on “Proceed” under Income Tax as highlighted in picture below.

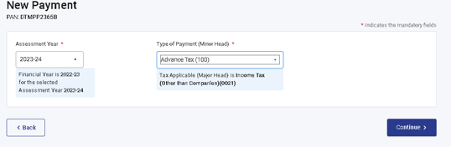

- Next step is to select relevant “Assessment Year” and “Type of payment” and then click on “continue”

Note: – Under type of payment, since it is an Advance tax payment select Minor Head 100 (Advance Tax) as shown in picture.

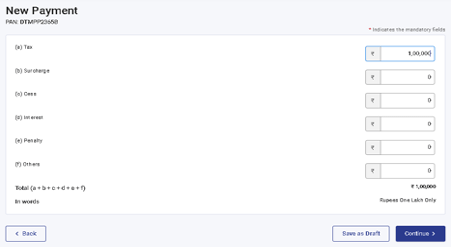

- Next step is to put amount in the “Tax” row and click on “Continue”.

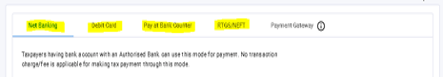

- Next step is to select the mode of payment (i.e. whether net banking /Debit card/ RTGS/NEFT/ etc).

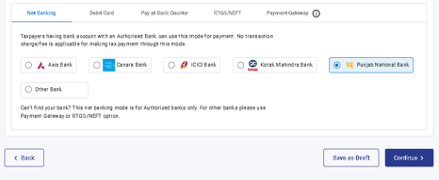

- We use net banking method, so after selecting the mode the next step is to select the bank and once bank is selected click on “Continue”.

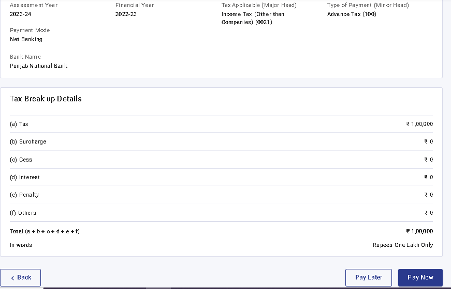

- After clicking on continue a new page will appear, basically a payment preview. All the assessee is supposed to verify the details and click on “Pay Now”.

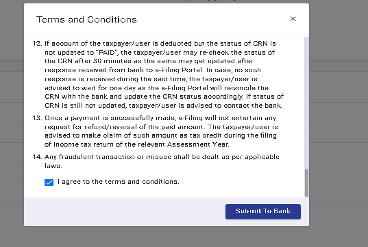

- After clicking on pay now a pop up will appear of “Terms & conditions”, the assessee is supposed to scroll down till end and click on “I Agree to the terms and conditions “and “Submit to Bank”.

- After clicking on submit to bank you will be redirected to concerned bank’s page then you will to punch the bank details and make the payment. And once payment is done kindly download the challan.

Jitesh Telisara & Associates LLP, CA In Pune is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services