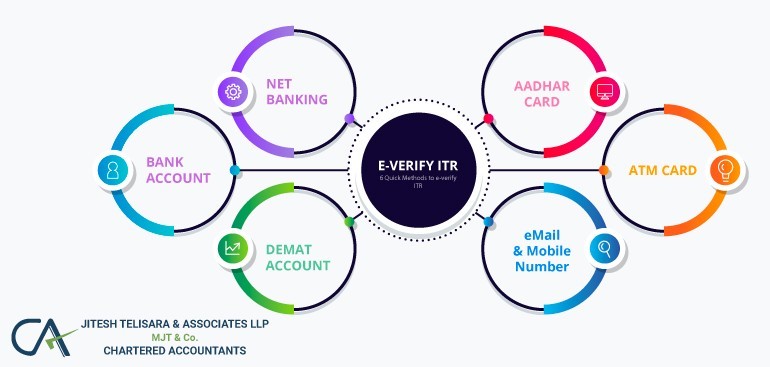

Filing your income tax return is an essential responsibility for every taxpayer, ensuring compliance with tax regulations and contributing to the smooth functioning of the economy. After successfully filing your tax return electronically, the next crucial step is to e-verify it. E-verification is the process of validating and authenticating your tax return filing electronically, eliminating the need for physical verification.

[…]

[…]

Advance tax is the amount of income tax that is paid much in advance rather than a lump-sum payment at the year-end. Also known as, earn tax.Advance tax is to be paid in instalments as per the due dates decided by the income tax department.