Q1: Is TDS applicable if the property is bought from an NRI?

No. If the seller is a Non-Resident Indian (NRI), Section 195 applies instead of Section 194-IA. In such cases, different rates apply and the buyer must have a TAN.

Q2: How is TDS calculated in the case of installment payments?

TDS must be deducted on every installment paid, not just the final payment. A separate Form 26QB must be filed for each payment made.

Q3: What if there are multiple buyers or sellers?

If there are joint parties, Form 26QB must be filled out for each unique buyer-seller combination for their respective shares.

Q4: Should TDS be calculated on the Stamp Duty Value or Purchase Price?

As per the latest amendments, TDS is calculated on the higher of the Actual Consideration or the Stamp Duty Value.

Q5: What happens if I deduct 1% TDS but the seller’s PAN is later found to be inoperative?

The Income Tax Department will treat this as a “Short Deduction.” As the buyer, you will be liable to pay the remaining 19% balance out of your own pocket, along with interest, before you can rectify the Form 26QB. Always verify the seller’s PAN status before making the payment.

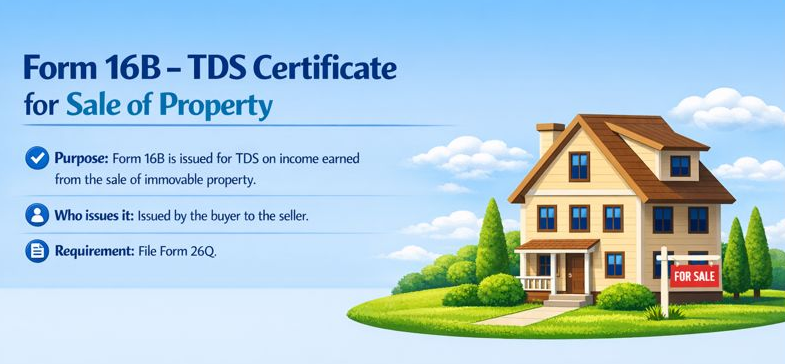

Q6: Why does the Seller require Form 16B?

The seller needs it to prove the 1% was already paid so they don’t get taxed twice, and to ensure the credit reflects in their official tax records. This prevents the Income Tax Department from blocking their tax refunds due to “mismatched data.”

Q7: Is TDS applicable to the purchase of agricultural land?

No. Section 194-IA specifically excludes rural agricultural land. However, urban agricultural land may still attract TDS.