The Finance Act 2021 has introduced two new sections in the Income Tax Act, viz., Section 206AB & Section 206CCA.

This is a special provision that provides for deducting or collecting tax at higher rates. Through these sections, an attempt has been made to penalize & trace down the defaulters, who, despite having taxable income do not file their income tax returns. Section 206AB provides for higher rates of TDS while Section 206CCA specifies the higher rates of TCS.

Section 206AB states that where, for any transaction, a TDS has to be deducted under any provision of the Income Tax Act, such TDS shall be deducted at a higher rate if the transaction is entered with a Specified Person. Similarly, for any transaction where a TCS has to be collected, such TCS shall be collected at a higher rate if the transaction is done with the Specified Person.

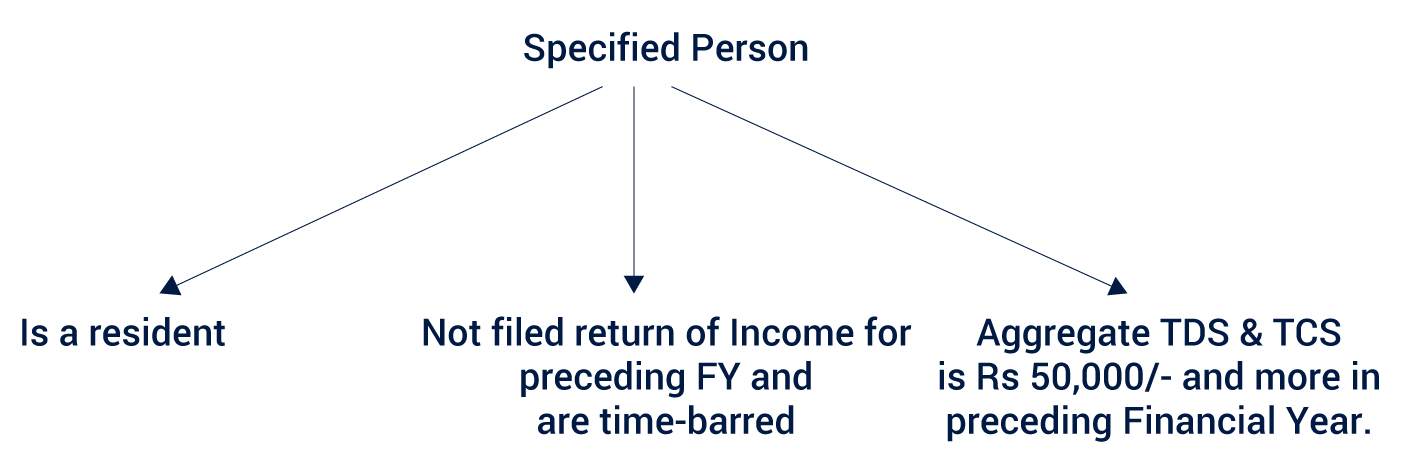

Who is the specified person?

A specified person shall be any person who fulfills below mentioned two conditions: –

- Any person who has not filed the return of income preceding FY relevant to the previous year in which the tax is to be deducted or collected and the due date to file these returns of income has expired under section 139(1); and

- The total tax deducted and tax collected, of such person, in aggregate, is Rs 50,000/- and more for last Financial Year; and

Provided that, it shall not include a non-resident who does not have a permanent establishment in India.

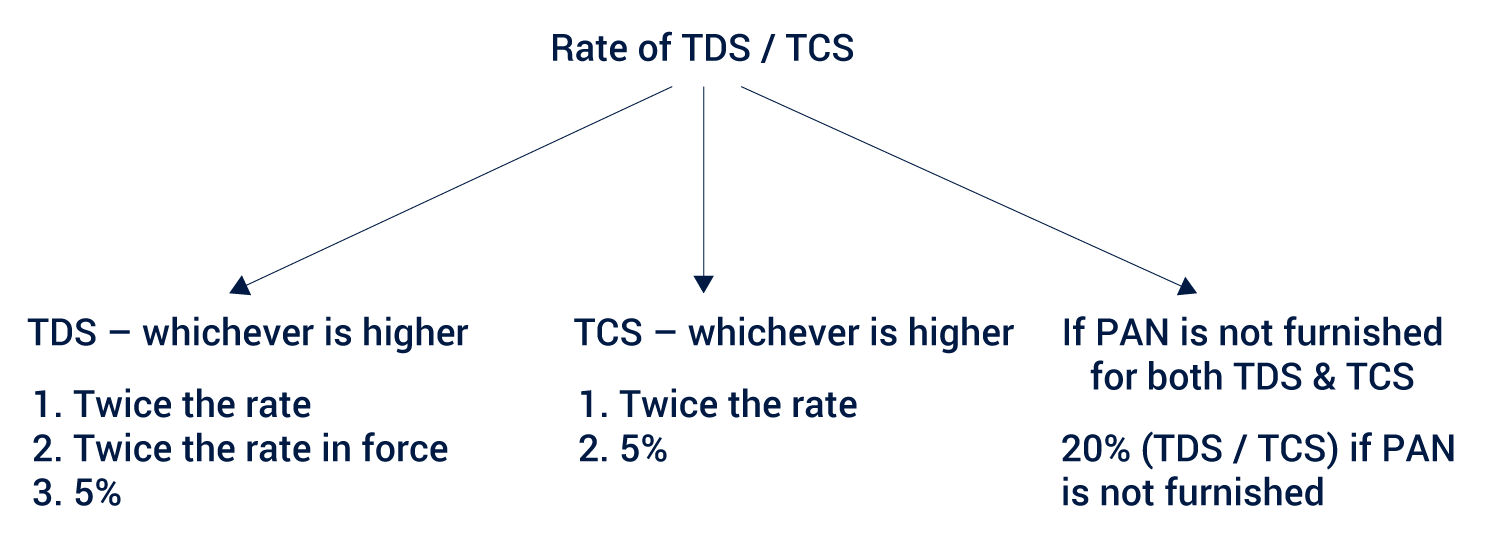

What are the rates of TDS and TCS?

Where a TDS has to be deducted from a specified person, it shall be deducted at the higher of the below-mentioned rates: –

- Twice the rate specified in the relating provision/section of the act; or

- Twice the rate of TDS in force; or

- At the rate of 5%

Where a TCS has to be collected of a specified person, it shall be collected at the higher of the below-mentioned rates: –

- Twice the rate specified in the relating provision/section of the act; or

- At the rate of 5%

In case where the PAN is not furnished by the specified person, TDS or TCS shall be deducted/collected at 20%

What are the exceptions?

Section 206AB and Section 206CCA shall not apply to the below-mentioned transactions: –

- Section 192 – Where TDS has to be deducted on payment of Salary

- Section 192A –Where TDS has to be deducted from the withdrawal of balance from the recognized provident fund.

- Section 194B – Where TDS has to be deducted from Winnings from the lottery, crossword, puzzle, card game, etc.

- Section 194BB – Where TDS has to be deducted from Winnings from horse races

- Section 194LBC – Where TDS has to be deducted from income from investment in securitisation

- Section 194N – Where TDS has to be deducted from the payment of certain amounts in cash.

- Consideration paid for the sale of immovable property (Section 194-IA)

- Rent payment to the landlord above Rs 50,000 (Section 194-IB)

- Payment for contractual or professional services above Rs 50 lakh (Section 194M)

- Transfer of virtual digital assets (Section 194S) to:

- Individual or HUF, whose gross business turnover is less than Rs 1 crore or gross receipts from the profession are less than Rs 50 lakhs during the preceding financial year, or

- Individual/HUF who does not have ‘income from business or profession’.

Section 206AB & Section 206CCA in a glance

Jitesh Telisara & Associates LLP, CA In Pune is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services