Every taxpayer registered under GST has to pay his tax liability after adjusting input tax

credit before filing the return. You can either pay online or offline.

- Online Payment Option

Step 1: Log in to GST Portal (www.gst.gov.in) with valid credentials.

Step 2: In case of GSTR1/IFF payment, select PAY TAX on the dashboard.

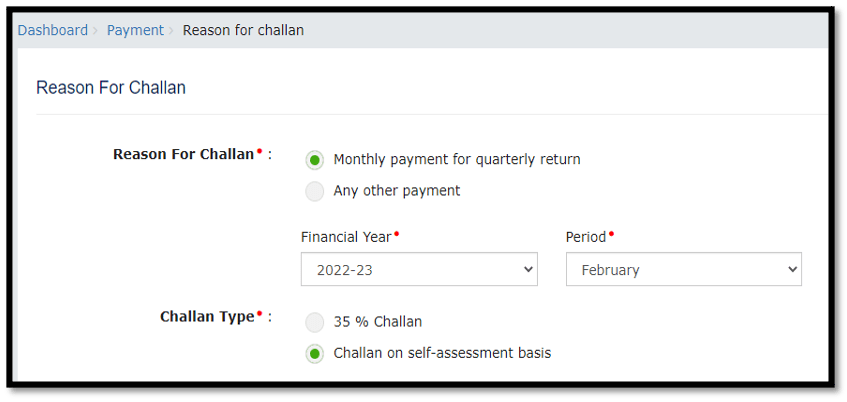

a. To make payment for the first and second month, select Monthly payment for quarterly return as Reason for challan option and Challan on self-assessment basis as Challan type.

a. To make payment for the first and second month, select Monthly payment for quarterly return as Reason for challan option and Challan on self-assessment basis as Challan type.

Note: In case of third month i.e. GSTR3B payment, go to FILE RETURNS on the dashboard and select respective quarter and period. An auto-populated challan amounting to liabilities for the quarter net off credit utilization and existing cash balance can be generated and used to offset liabilities.

b. In case of payment needs to be done before hand of filing the return, select Any other Payment as Reason for challan option

- Offline Payment Option

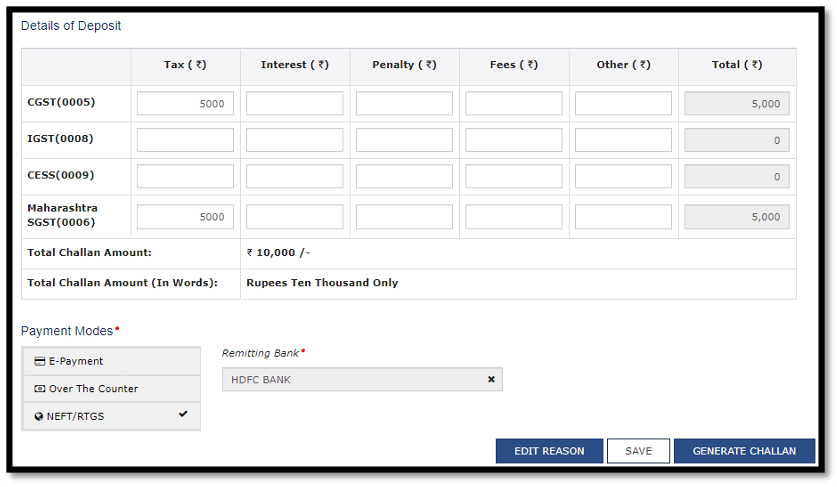

Step 1: In the Payment Modes option, select the NEFT/RTGS as payment mode. In the REMITTING BANK drop-down list select the name of the remitting bank and click the GENERATE CHALLAN button.

Step 2: Take a print out of the Challan and visit the selected Bank. Mandate form will also be generated simultaneously.

Step 2: Take a print out of the Challan and visit the selected Bank. Mandate form will also be generated simultaneously.

Step 3: Pay using Cheque through your account with the selected Bank/ Branch. You can also pay using the account debit facility.

Step 4: The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours.

Step 5: Status of the payment will be updated on the GST Portal after confirmation from the Bank.

Step 6: Go to Services > Payments > Challan History command.

Jitesh Telisara & Associates LLP, CA In Pune is a professionally managed firm catering to domestic and international clients with a broad range of services in domestic and international taxation, regulatory and advisory services and crosses border transaction-related services.

The team at the firm has dedicated and experienced professionals and associates like Chartered Accountants, Company Secretary and Consultants to provide end to end services to your business. With the effort of gaining a deep understanding of your business, the team is committed to providing valuable, consistent and efficient services based on its in-depth knowledge and wide experience in the areas of audit, taxation, regulatory compliances, and related business services.

Our services: GST Consultant, IT returns consultant, Corporate law, Taxation, Regulatory & Advisory Services