CBDT introduced a new section in the Income Tax Act, w.e.f.1st September 2019, to bring in transactions of cash withdrawals under the tax net. According to Section 194N, all the Banks to which Banking Regulation Act applies, a Co-operative Society and a post office shall be responsible to deduct TDS, if any person withdraws cash from the account/s maintained with them, being the amount or aggregate of amounts exceeding rupees one crore during the financial year.

Search

Recent Post

Categories

Tag Cloud

Advance Tax Payment

Best Chartered Accountant Firm in Pune

ca firms in pune

ca firms near me

CA In Kalyaninagar

CA in Kalyani Nagar

CA in Kharadi

CA In Koregaon Park

CA In Koregoan Park

ca in pune

ca in vimannagar

CA in Viman nagar

CA Near Me

chartered accountant firm near me

chartered accountant firms near me

chartered accountant In Kharadi

chartered accountant in pune

chartered accountant in pune ca in pune

chartered firm near me

company registration in pune

Compliance of form 11

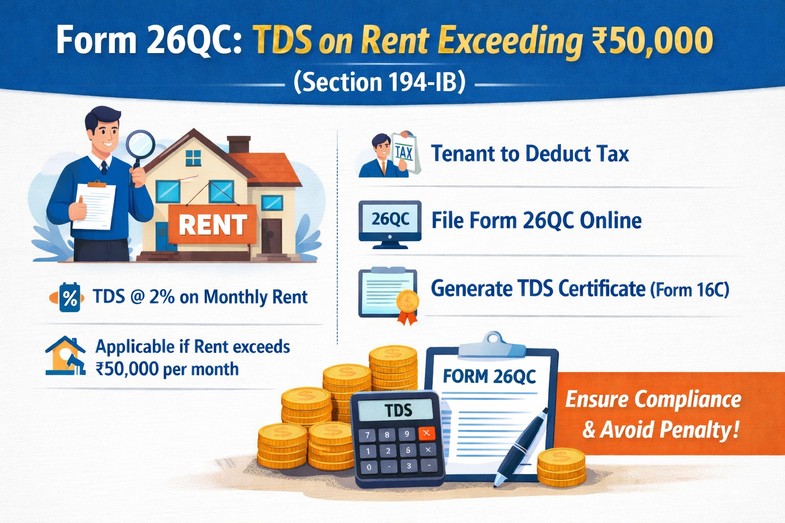

Deduction of rent Paid

GST Payment

GST Payment Online

gst return services in pune

GTA

how to e verify income tax return

how to e verify itr

How to make PTRC Payment

incometax

income tax consultant in pune

income tax consultant near me

income tax consultant pune

Interest On Housing Loan

IT returns consultant

itr e verification

msme

msme payment terms

online ca services

Section 80 EEA

section 80eea of income tax act

section 80eeb

Section 194P of the Income Tax

tax consultant near me

Updated Income Tax Return